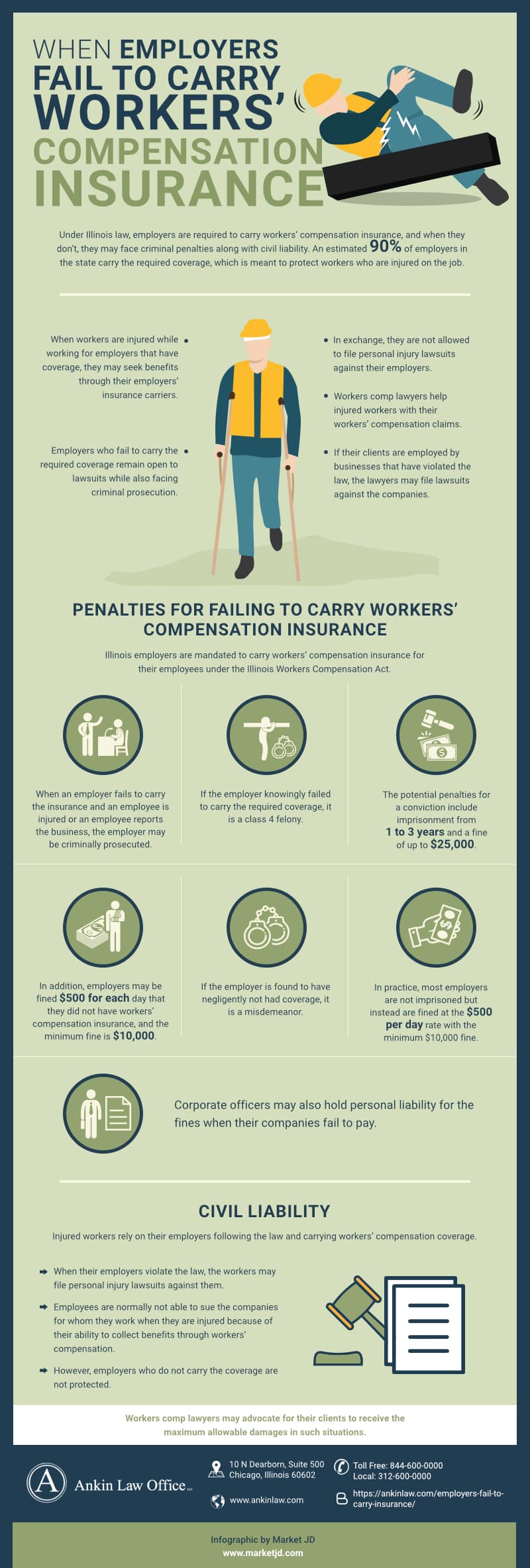

Under Illinois law, employers are required to carry workers’ compensation insurance. When an employer has no workers’ comp insurance, they may face criminal penalties along with civil liability. An estimated 90% of employers in the state carry the required coverage, which is meant to protect workers who are injured on the job.

Table of Contents

(Article continues below Infographic)

______

When workers are injured while working for employers that have coverage, they may seek benefits through their employers’ insurance carriers. In exchange, they are not allowed to file personal injury lawsuits against their employers. Employers who fail to carry the required coverage have broken their end of the legal bargain, leaving them open to lawsuits by their injured employees while also facing criminal prosecution. Workers’ comp lawyers in Chicago help injured workers with their workers’ compensation claims. If their clients are employed by businesses that have violated the law by not providing workers’ comp insurance, the lawyers may file lawsuits against the companies.

Penalty for Not Having Workers’ Compensation Insurance

Illinois employers are mandated to carry workers’ compensation insurance for their employees under the Illinois Workers’ Compensation Act. When an employer fails to carry the insurance and an employee is injured or an employee reports the business, the employer may be criminally prosecuted. If the employer knowingly failed to carry the required coverage, it is a class 4 felony. The potential penalties for a conviction include imprisonment from one to three years and a fine of up to $25,000. In addition, employers may be fined $500 for each day that they did not have workers’ compensation insurance, and the minimum fine is $10,000. If the employer is found to have negligently not had coverage, it is a misdemeanor. In practice, most employers are not imprisoned but instead are fined at the $500 per day rate with the minimum $10,000 fine. Corporate officers may also hold personal liability for the fines when their companies fail to pay.

Who Is Not Covered Under Workers’ Compensation Insurance?

Although it is a legal requirement for employers to provide workers’ compensation benefits, some businesses are able to legally exempt themselves from coverage. Limited liability companies, corporate officers, business partners, and sole proprietors are not required to maintain coverage. Additionally, some workers are exempt from being covered under workers’ compensation benefits through a 1099 form. This exemption includes independent contractors, freelancers, and consultants. Since these individuals pay their own income tax, employers are not required to cover them under workers’ compensation law.

In addition to the above-mentioned employees, railroad workers are exempt from coverage under workers’ compensation. Instead, they can file for compensation through the Federal Employers’ Liability Act (FELA), also known as the Railroad Workers Act. Additionally, farm laborers and federal employees are not inherently covered by state workers’ comp benefits. Federal employees can, however, recover compensation through the Federal Employees Compensation Act (FECA).

Can I Sue my Employer for Not Having Workers’ Compensation Insurance?

Injured workers rely on their employers following the law and carrying workers’ compensation coverage. When their employers violate the law, the workers may file personal injury lawsuits against them. While employees are normally not able to sue the companies for whom they work when they are injured because of their ability to collect benefits through workers’ compensation, employers who do not carry the coverage are not protected. Workers’ comp lawyers may advocate for their clients to receive the maximum allowable damages in such situations.